European Regulatory Roll-out Package guide

From XBRLWiki

| Revision as of 10:38, 18 December 2013 (edit) Pablo.navarro (Talk | contribs) (→Determine the level of XBRL adoption) ← Previous diff |

Revision as of 10:40, 18 December 2013 (edit) Pablo.navarro (Talk | contribs) (→Plan and prepare the new reporting models) Next diff → |

||

| Line 120: | Line 120: | ||

| ===Plan and prepare the new reporting models=== | ===Plan and prepare the new reporting models=== | ||

| + | From the regulator's perspective there are two main key drivers in favour of XBRL adoption: compliance with new regulation directives and ensuring the accuracy of data reported by reporting entities. | ||

| + | |||

| + | Compliance with new regulation directives implies the adequacy of the reporting business models and rules to the XBRL language and semantics to be implemented. | ||

| + | |||

| + | The most important requirement for financial supervision reporting is data accuracy. Reported data, for legal reasons, is expected to be: | ||

| + | :* accurate for arithmetic purposes; | ||

| + | :* calculated accurately based on the required definition; | ||

| + | :* preserved during the data transfer process. | ||

| + | |||

| + | It is also a good idea to plan and prepare the adaptation of all data requirements. For this, the regulator needs | ||

| + | to learn and understand the following topics: | ||

| + | :* XBRL basics – terminology, syntax and structure; | ||

| + | :* how the data models correspond to the business model and semantic rules into XBRL syntactic schemas and filers forms that define reporting data. Consider information requirements which could have causes additional issues to be solved in the modelling architecture. | ||

| ===Review existing reception infrastructure=== | ===Review existing reception infrastructure=== | ||

Revision as of 10:40, 18 December 2013

CEN Workshop Agreement

Status: Approval Final Draft - Formal Vote

CEN WS CWA3 Convenor: Aitor Azcoaga (EIOPA)

CEN WS XBRL Experts: Pieter Maillard (Aguilonius), Pablo Navarro (Atos)

Editing rules

Editorial comments should be highlighted as follows: A comment

Text or rules in discussion (white): Some text

Text or rules already aligned (green): Some text

Text or rules to be deleted (red): Some text

Text to be delivered (blue): Some text

Foreword

This document has been prepared by CEN/WS XBRL, the secretariat of which is held by NEN.

CWA XBRL 003 consists of the following parts, under the general title Improving transparency in financial and

business reporting — Standard regulatory roll-out package for better adoption

— Part 1: XBRL Supervisory Roll-out Guide

— Part 2: XBRL Handbook for Declarers

This CWA is one of a series of related deliverables. The other deliverables are:

CWA XBRL 001 which consists of the following parts, under the general title Improving transparency in

financial and business reporting — Harmonisation topics:

— Part 1: European data point methodology for supervisory reporting.

— Part 2: Guidelines for data point modelling

— Part 3: European XBRL Taxonomy Architecture

— Part 4: European Filing Rules

— Part 5: Mapping between DPM and MDM

CWA XBRL 002 Improving transparency in financial and business reporting — Metadata container

Introduction

This document is intended to provide guidelines to European regulators in the implementation and roll out of

the reporting standard using XBRL across Europe.

The set of recommendations included in this document aim to facilitate the implementation of European

National Supervisors to adopt XBRL in any of the reporting frameworks. The following sections will provide

guidance on the use, understanding, preparation, and extension of their filings in eXtensible Business

Reporting Language (XBRL).

This guidance is in the form of notes in association with the pertaining requirements clause and uses the

terms “should” (recommendation), “may” (allowance) and “can” (possibility). Organizations wishing to

implement this CWA would be expected to consider all recommendations where the term "should" is used.

COREP, FINREP (and Solvency II or other future) XBRL taxonomies are offered to European regulators for

national implementation. The first releases (2006) of the COREP and FINREP XBRL frameworks have proven

that a standardized technical roll-out package is needed to increase the adoption rate and avoid

implementation variances, which have a detrimental effect on the overall cross-border effectiveness of using

one reporting standard. As well this roll-out guide tries to promote the economies of scale for a better

adoption.

Scope

This CWA is a general guide to XBRL oriented towards national regulators on how to implement, extend and

manage XBRL taxonomies. The guidance and recommendations included in this CWA have been created for

regulatory filings in the context of European supervisory reporting.

In this document, “regulatory filings” encompasses authoritative financial reporting standards and generally accepted accounting principles/practices (or GAAP), regulatory reports whose subject matter is primarily financial position and performance and related explanatory disclosures, and data sets used in the collection of financial statistics; it excludes transaction- or journal-level reporting, primarily narrative reports (for example, internal controls assessments) and non-financial quantitative reports (for example, air pollution measurements).

How to start with XBRL. Supervisory Perspective

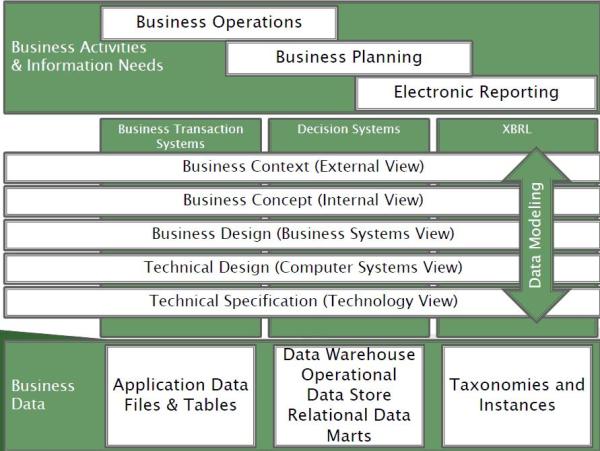

This section describes how the XBRL standard can be implemented from the regulator's perspective.

First, we present different levels of XBRL adoption, to help define the supervisor's strategy.

This is followed by a description of the minimum steps required to facilitate initial understanding of the XBRL standard, and guidelines describing the review and the likely impact on existing infrastructure and internal information systems.

Finally, we suggest additional considerations which should be taken into consideration during preparation and planning, to help regulators establish which services they need to implement to enable reporting entities to adhere to the XBRL standard. Figure 1 presents an overview of the activities described in the section.

Determine the level of XBRL adoption

Widespread adoption of XBRL as a business information exchange format has revealed a number of implementation alternatives.

Selection of a specific adoption strategy by the regulator establishes the roadmap for implementation from the regulator's current reporting framework to a framework which supports the new legislation. This step is probably the most important step in XBRL adoption.

Attending to the level of penetration (or permeability) of XBRL between the Regulator and the Filing entities the adoption can be classified in the following:

- Use of XBRL solely for the electronic exchange of data between the national regulator and European Authority to comply with legislation.

- Adaptation of existing reporting channels to receive XBRL reports from reporting entities as well as using XBRL for the electronic exchange of data between the national regulator and the European Authority. In this scenario, regulators could make use of automated business rules to validate data received from reporting entities.

- Full exploitation of XBRL for internal reporting models (multidimensional data analysis) in addition to the use of XBRL for receiving data from reporting entities and electronic exchange between the national regulator and the European Authority as described above.

Depending on the strategy selected, the regulator must also determine which XBRL enabled software applications should be made available to their internal departments and also to reporting entities under their jurisdiction.

To name a few examples for consideration: XBRL validation, report visualization, conversion from existing data formats, filing forms, monitoring, security enforcement and versioning that will facilitate the analysis and supervision of reported information.

Plan and prepare the new reporting models

From the regulator's perspective there are two main key drivers in favour of XBRL adoption: compliance with new regulation directives and ensuring the accuracy of data reported by reporting entities.

Compliance with new regulation directives implies the adequacy of the reporting business models and rules to the XBRL language and semantics to be implemented.

The most important requirement for financial supervision reporting is data accuracy. Reported data, for legal reasons, is expected to be:

- accurate for arithmetic purposes;

- calculated accurately based on the required definition;

- preserved during the data transfer process.

It is also a good idea to plan and prepare the adaptation of all data requirements. For this, the regulator needs to learn and understand the following topics:

- XBRL basics – terminology, syntax and structure;

- how the data models correspond to the business model and semantic rules into XBRL syntactic schemas and filers forms that define reporting data. Consider information requirements which could have causes additional issues to be solved in the modelling architecture.